how to calculate nh property tax

Divide the total transfer tax by. TurboTax Experts Help You Get Every Dollar You Deserve.

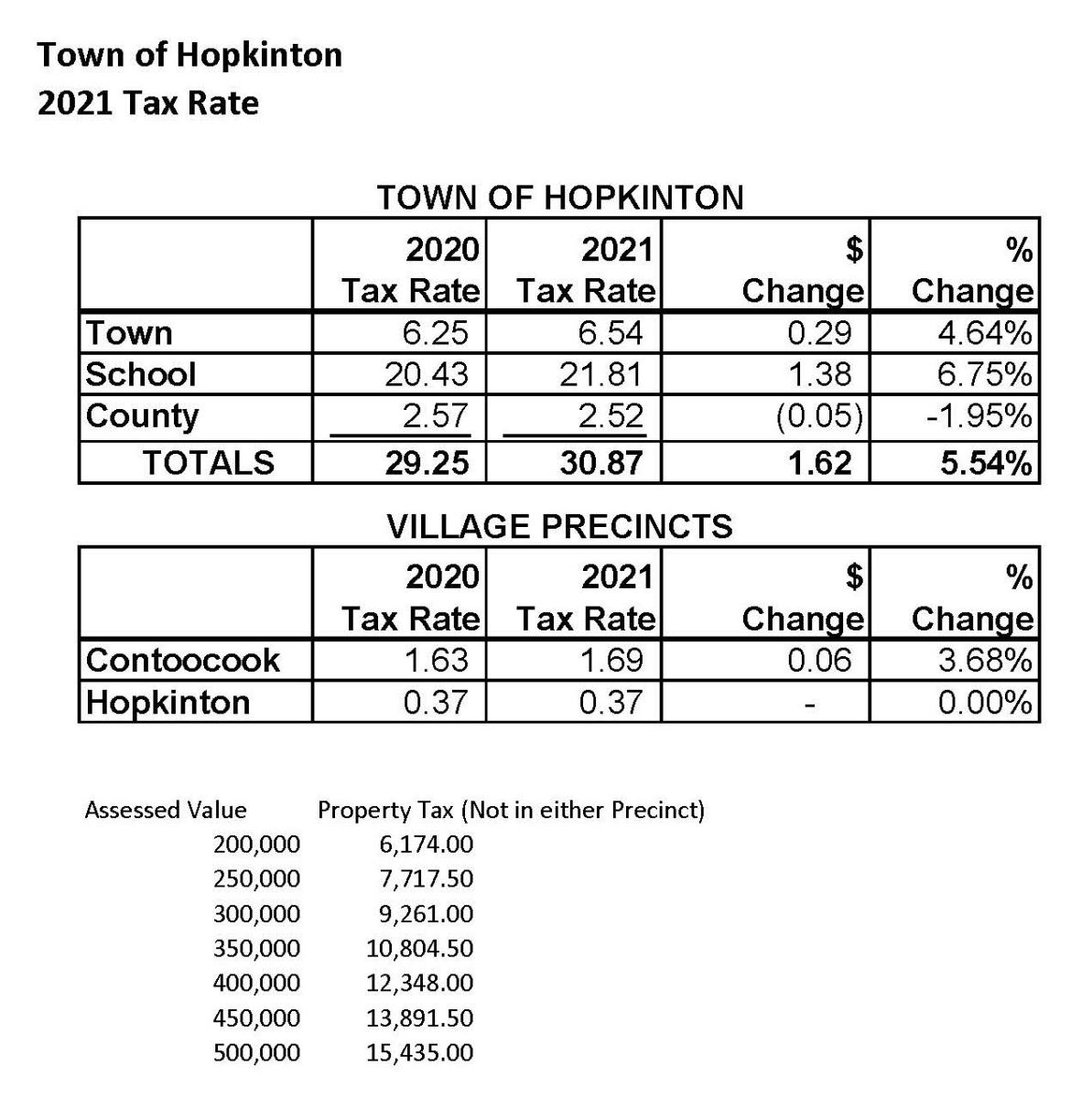

2021 Tax Rate Set Hopkinton Nh

Ad No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence.

. There is however a 5 tax on dividends and interest. According to findings released by financial website WalletHub the state. The information provided by the Paycheck Calculator.

New Hampshire Property Tax Calculator to calculate the property tax for your home or investment asset. You calculate property taxes according to multiplying the assessed value of your property by the mill levy a process that is used for the calculation of mill levies. TurboTax Experts Help You Get Every Dollar You Deserve.

To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply. New Hampshires tax year runs from April 1 through March 31. Income tax calculator Property Tax Estimate of Property Tax Owed As noted above you pay your property tax rate on every 1000 your property is assessed to be worth.

NH Property Taxes also known as The Official New Hampshire Assessing Reference Manual. File With 100 Confidence Today. Wages and salaries in New Hampshire are not subject to income tax.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. To estimate your real estate taxes you merely multiply your homes assessed value by the levy. The assessment ratio is the ratio of the home value as determined by an official appraisal usually completed by a county assessor and the value as determined by the market.

In new hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location. 300000 x 015 4500 transfer tax total 2. 2021 Taxes The property tax calculated does not include any exemptions elderly veterans etc that you may be entitled to.

This Manual is a product of the Assessing Standards Board manual sub-committee as. The 2020 real estate. Heres how to find that number.

Enter your Assessed Property Value Calculate Tax. Ad No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. Property Taxes However there is some variance in solar prices in different parts of the state.

Our New Hampshire Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Take the purchase price of the property and multiply by 15. Property tax is calculated based on your home value and the property tax.

The Center Square A new study shows New Hampshire ranks third highest in the country for high property taxes. 2021 New Hampshire Property Tax Rates. Please note that we can.

In new hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location. Click here for a map of New Hampshire property tax rates. So if your home is worth 200000 and your property tax rate is 4 youll pay.

By law the property tax bill must show the assessed value of the. File With 100 Confidence Today. NEW -- New Hampshire Real Estate Transfer Tax.

What Taxes Do You Pay In Nh. Multiply the rate by 1000 and you get the property tax rate per 1000 of property value which is how the rate is usually stated. NH Property Taxes - 3 Things You Should Know to Calculate the Property Tax on a Home in NHYes NH has high property taxes but here is how they are calculat.

New Hampshire Property Tax Calculator Smartasset

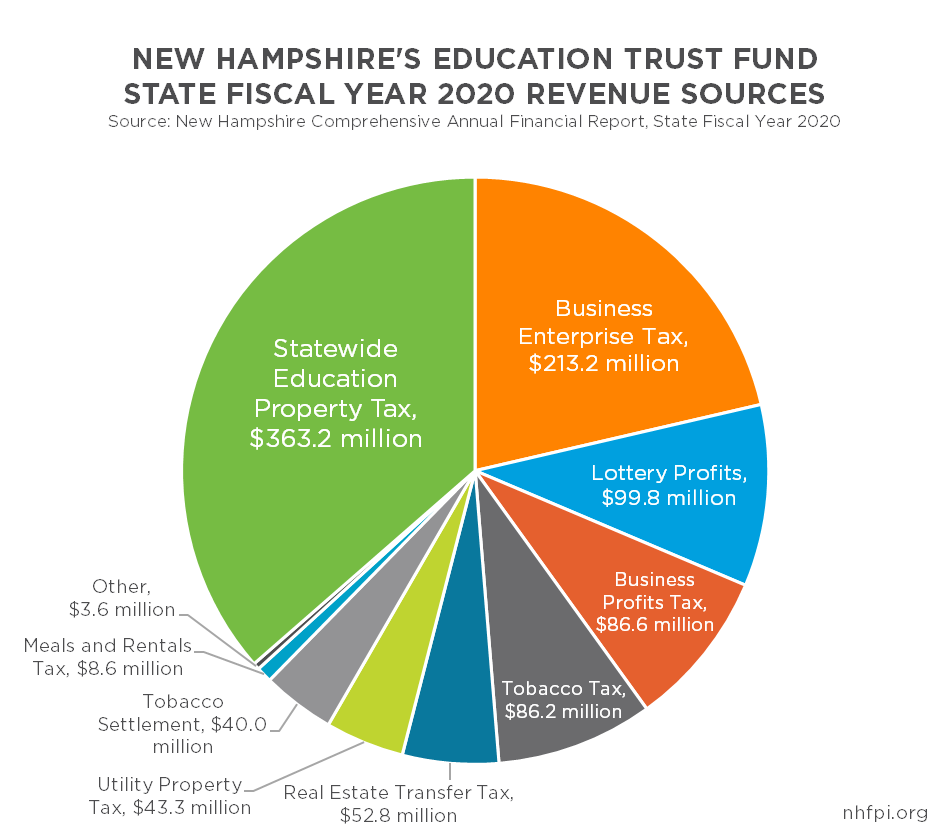

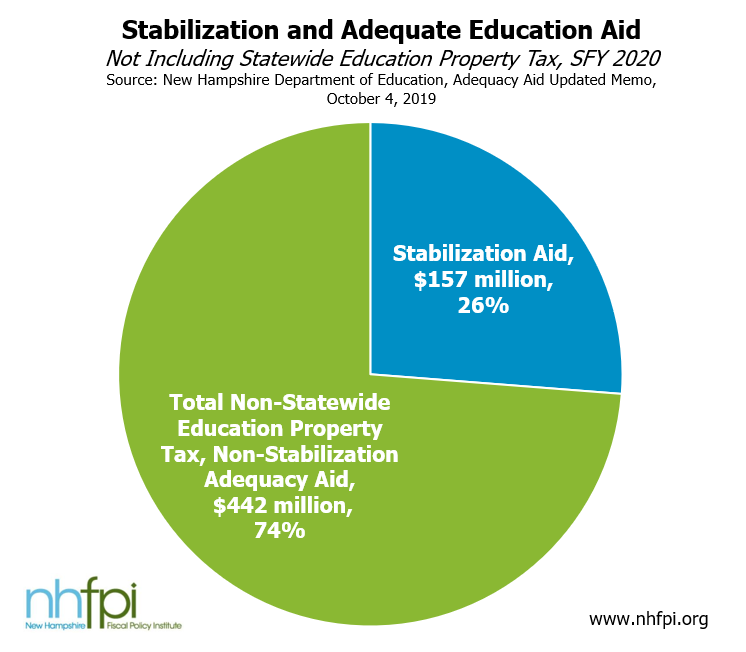

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Report School Funding Method Used Across N H Isn T Fair To Students Or Taxpayers

Understanding New Hampshire Taxes Free State Project

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

City Launches Online Property Tax Calculator To Help Estimate New Tax Bill Manchester Ink Link

Monday Map Tax Increase From Fiscal Cliff For Median Four Person Family In Each State Fiscal State Tax Tax

Historical New Hampshire Tax Policy Information Ballotpedia

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

How To Calculate Transfer Tax In Nh

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties Reachinghighernh

New Hampshire Covid Vaccine Rates By Town

Understanding New Hampshire Taxes Free State Project

The Ultimate Guide To New Hampshire Real Estate Taxes

Chemistry291 Hand Note Znbr2 Compound Name What Is The Name Of Znbr2 Names Science Topics Chemical Formula

New Hampshire Property Tax Calculator Smartasset